Primer: What’s in the House-Passed Radical Reconciliation Ruse?

Overview

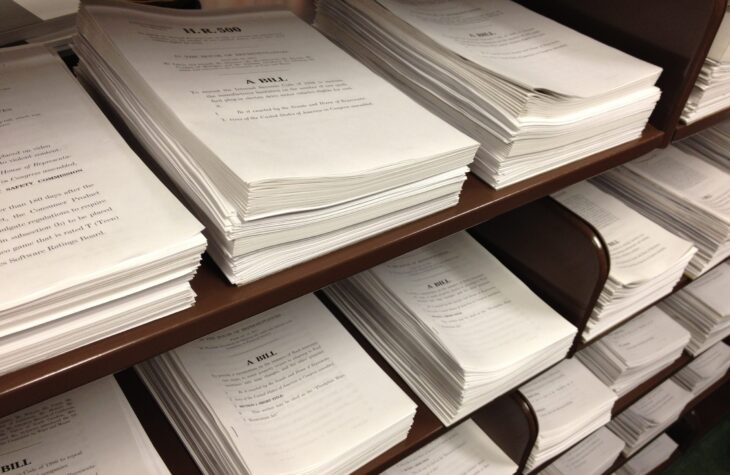

The Democrat-controlled House of Representatives passed the colossal $2 trillion “Build Back Better” reconciliation bill on November 19, 2021 along partisan lines. This radical legislation now heads over to the U.S. Senate where it awaits a “Byrd bath” to determine which extraneous provisions unrelated to the fiscal note of the bill will be discarded.

The Congressional Budget Office (CBO) released its cost analysis of the deficit and inflation-driving reconciliation bill on November 18, 2021, just hours before the House passed the legislation. In sum, CBO found that the bill would increase the deficit by $367 billion over the next decade. This follows two independent analyses from the Committee for a Responsible Federal Budget and Penn-Wharton that concluded the legislation would increase the deficit between $200 and $300 billion. Additionally, these analyses outline that without the sunsets, the actual total cost of the legislation is between $4.6 trillion and $4.9 trillion.

The legislation however includes significant budget gimmicks that will greatly increase the overall cost of the bill to taxpayers and deepen deficits for the foreseeable future. Among these gimmicks:

- An increase for the cap on the tax deduction for state and local taxes (SALT) from $10,000 to $80,000 through 2030 followed by a decrease back down to $10,000 in 2031. In other words, the bill “pays for” tax cuts for coastal elites on the front end by assuming a massive tax hike on the back end of the budget window. This will not happen.

- Implementation of significant spending cliffs that effectively use permanent tax increases to pay for “temporary” spending that is unlikely to remain temporary. Analyses from the Committee for a Responsible Federal Budget estimated that extending the provisions in the bill after they sunset will add between $2 and $2.5 trillion to the cost.

- A double count of Medicare taxes to “pay for” provisions in the bill which not only hastens the continued insolvency of Medicare, but serves as a fake spending offset.

Previous analyses of the initial version of the bill identified 20 radical policies embedded in the so-called “Build Back Better” legislation. The updated provisions are included below.

Radical Proposals of “Build Back Better”

As hard-working Americans experience rapidly increasing inflation, the Democrat-controlled House has passed a potential $5 trillion monstrosity that doubles down on a far-left agenda and pain for the working class.

Fiscal Impact

- A minimum $367 billion in additional deficit spending with potential for nearly $2.5 trillion beyond the constrained analysis outlined by CBO.

- The highest personal income tax rate in the developed world.

- Nearly 90,000 new IRS enforcers who will be used to vastly increase audits on working-class Americans and small businesses.

- A catalyst for increased inflation.

Radical Policies

- An astounding $400 billion to implement government-controlled “child care and pre-K.”

- Some $555 billion in Green New Deal subsidies and tax credits.

- A 900 percent increase in Fair Labor Standard Act fines on small businesses to coerce them to adhere to the demands of union bosses.

- Penalties of up to $700,000 on small businesses for violating new Occupational Safety and Health Administration (OSHA) mandates.

- A $130 billion expansion in Obamacare subsidies.

- An $8 billion home heating tax on natural gas producers that could eliminate nearly 100,000 jobs.

- Nearly $2 billion in taxpayer-funded subsidies for news organizations and journalists.

- A $2.5 billion slush fund for environmental organizations to advance “tree equity.”

- Inclusion of $250 million in taxpayer-funded grants to infuse maternity care training with Critical Race Theory.

- A new $3 billion program called the “Community Restoration and Revitalization Fund” that would allow the Department of Housing and Urban Development (HUD) to award taxpayer-funded competitive grants to redesign neighborhoods based on “disparities” in racial and ethnic home-ownership rates.

Conclusion

The budget reconciliation package now heads to the U.S. Senate after passage in the House of Representatives. The bill remains little more than a far-left wish list for the ruling class—a set of extreme policies designed to further ensure hard-working citizens are subservient to a bureaucratic elite determined to centrally plan the lives of American families while enriching themselves with power and control.